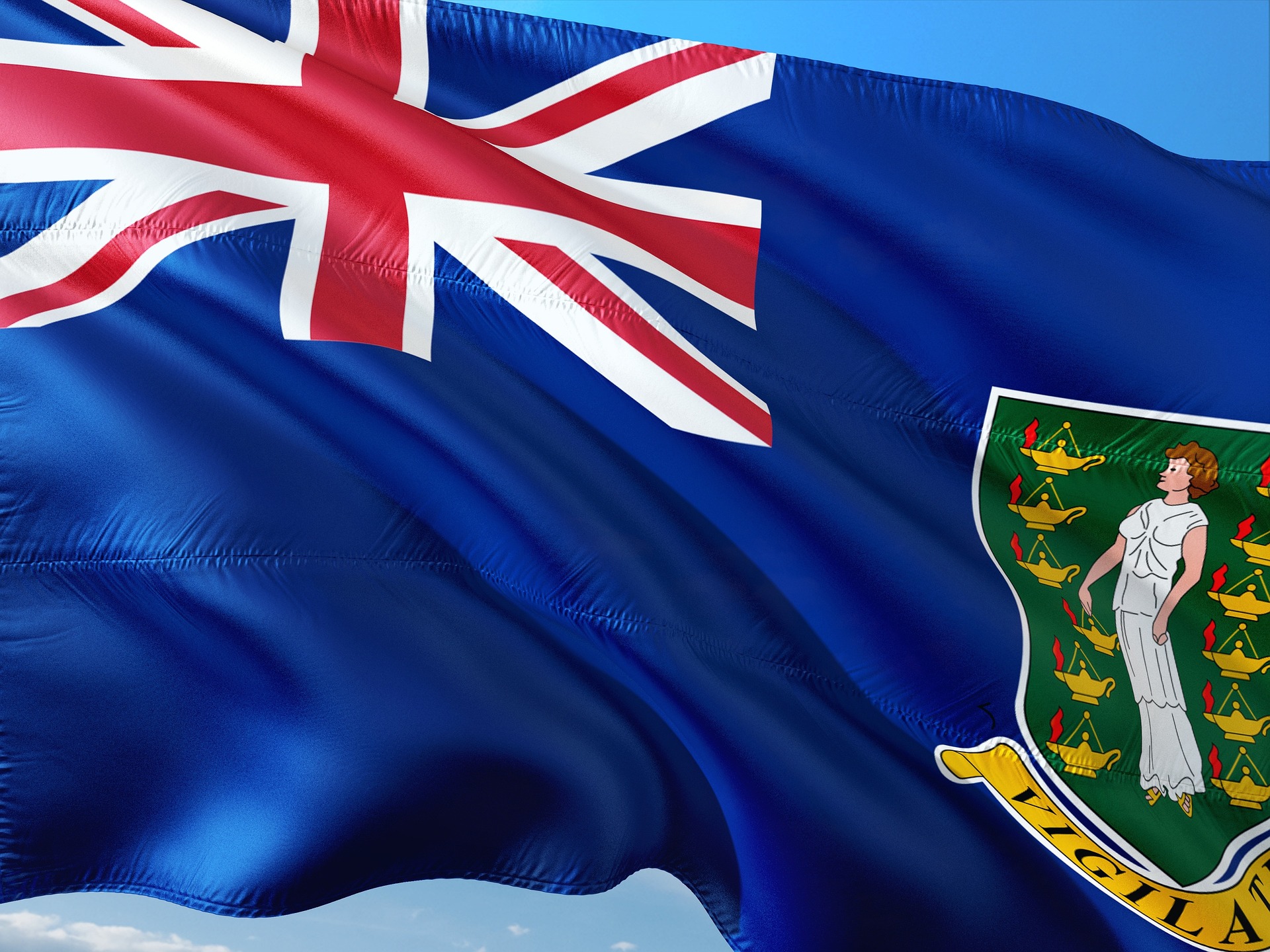

Welcome to our premier Company Incorporation services in the British Virgin Islands (BVI)! If you’re looking to establish a business in one of the world’s most renowned offshore financial centers, you’ve come to the right place. At FirmEU, we provide seamless and efficient solutions for incorporating your company in the British Virgin Islands.

In the British Virgin Islands (BVI), there are several types of legal entities that businesses choose from when incorporating. Each type of legal entity has its own characteristics and implications in terms of ownership, liability, and governance. The most common legal entities in the BVI include:

Here’s a detailed breakdown of our comprehensive services for Company Incorporation in the British Virgin Islands (BVI):

At FirmEU, we are committed to making the process of incorporating your company in the British Virgin Islands smooth, efficient, and successful. Our expert team is ready to assist you every step of the way, providing personalized solutions and top-notch support. Contact us today to explore the limitless possibilities of establishing your BVI company with ease and confidence!

Our benefits